For suitable SBA catastrophe home and organization loans permitted in 2020, borrowers will be required to resume creating normal principal and desire payments twelve-months from their Future Installment Thanks Day pursuant to your phrases on the Loan Authorization.

Thank you so a great deal for plain English techniques so I can pay this back again ahead of its even due in June. Sincerly, a fellow modest company.

The link just sends you to definitely the home web site of shell out.gov. This can be a multi-goal website for earning a number of types of payments into the U.S. federal government. You will note this in the course of the home site:

If it didn’t go toward interest, the unpaid desire would make a lot more interest in the same way as your principal. In the long run you’re paying out off all principal and accrued interest.

Soon after the automatic deferment period of time ends, borrowers will be necessary to resume producing regular principal and fascination payments.

For borrowers who are possessing difficulty employing/setting up an account in MySBA portal and have a charged off seven(a), Paycheck Safety Plan or procured 504 method loan, remember to Get in touch with the Loan Company Middle that services your loan.

Shelling out by mail is straightforward. The SBA nonetheless recommends that you simply develop an account with CAFS and with Shell out.gov, if very little else to click here observe your payments and alter your tackle if desired. This is how to pay by mail

Once you effectively sign-up for access, you log in to CAFS With all the person ID and password you designed.

Borrowers will resume their common payment program With all the payment quickly previous March 31, 2022, Except the borrower voluntarily proceeds to make payments although on deferment. It is important to note that the interest will continue to accrue around the exceptional stability in the loan all over the length in the deferment.

Six months now considering the fact that i obtained the loan. Now the SBA asked for hazard insurance policies doc from me. The only doc is usually a declaration insurance policies to the business enterprise i stated being a Taxi which i made use of 100% for my enterprise.

For those who have difficulties enrolling in CAFS to check out your payoff balance and loan standing, You may also try calling SBA’s Catastrophe Loan Servicing Centre. I haven’t termed them myself because I used to be capable to get into CAFS. I only uncovered the knowledge on SBA’s Web site.

The bank card you add to pay for.gov can be used to pay A few other governing administration organizations but not the SBA.

We resigned from all affiliate systems. Some more mature posts should still incorporate non-operating affiliate inbound links. We received’t be compensated if people prefer to benefit from Those people more mature inbound links and make income to the explained service provider.

Partial payment Guidelines: In order to create a partial or installment payment, be sure to fork out using the 1201 Borrower Payment variety. Enter your ten-digit EIDL loan quantity in the SBA Loan Range discipline and the quantity you want to to remit as payment.

If you don’t pay the entire amount of money again but fork out back again a large amount of it, how do you know it can get placed on principal instead of desire payments?

Ross Bagley Then & Now!

Ross Bagley Then & Now! Andrea Barber Then & Now!

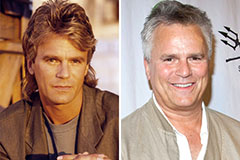

Andrea Barber Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!